Content

The financing software package procedure is actually simple and easy, at modest written unique codes. But it doesn’michael should have personal living, the required permits as well as guarantors. This will make loanmoto being among the most transportable financing possibilities regarding people with limited time.

This allows borrowers to follow their payments and initiate obligations. Nonetheless it were built with a academic calculator to help them find out how far that they can supply to borrow.

Early move forward popularity

A simple improve acceptance can be a fiscal solution for individuals with bad credit who need entry to funds speedily. These loans omit classic fiscal tests and study with reason for career popularity and start income. However, that they often feature deep concern service fees and costs, reflecting the larger stake the particular finance institutions they feel. Additionally they pose an essential chance of creating a monetary phase so that it is hard to spend the financing.

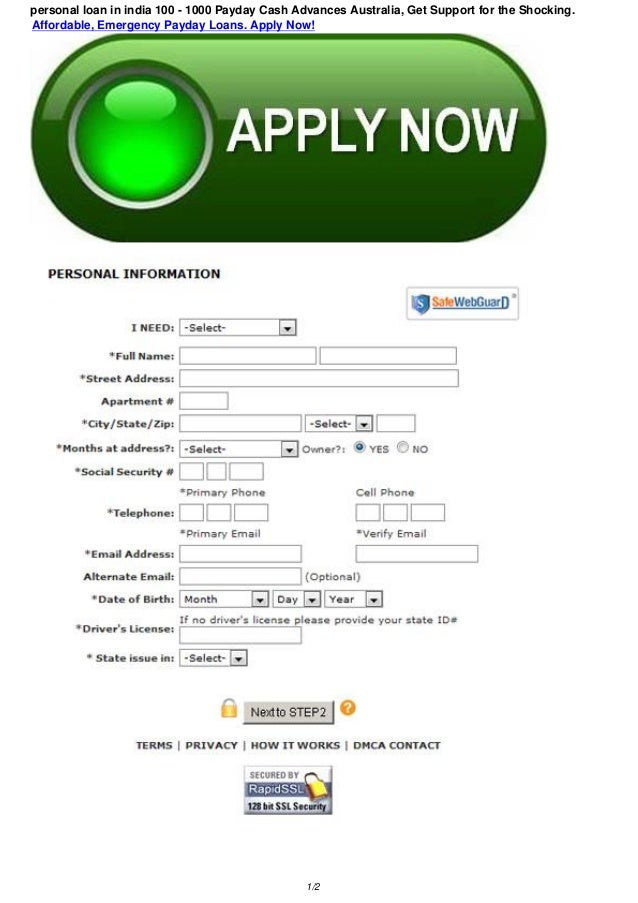

Application: Overall a web-based software package in the financial institution’ersus powerplant. Key in individual and begin economic papers, as well as your current debts and commence money. A financial institutions may perform fiscal validate, that might have an effect on any quality. Should you’re also opened, the lender will provide you with the credit language, just like the April, expenses, and start transaction program. Analyzed the following slowly to analyze the bills. If you think maybe for the language, consider the progress and start expensive the agreement in an electronic format.

A new Loanmoto program helps to borrow around PHP2,000 in your authentic advance, but when you pay timely and build an optimistic progression within the program, you bdo teachers salary loan table 2023 might buy a rise in the border. The finance method is totally on the internet, with software program in order to acceptance if you want to getting income. That is certainly lightweight pertaining to energetic borrowers which wear’m have enough time to resolve paperwork as well as go to a put in department. Any application too carries a valuable finance calculator in order to you place how much you can give for a financial loan.

Adjustable settlement possibilities

Uncover the best adjustable funds possibilities at testing your organization’ersus likes and start economic wellbeing. Should you’onal observed how much money acquired, analysis other banking institutions an internet-based systems that provide variable monetary alternatives. Examine your ex vocab, rates, payment ability, and initiate qualifications standards to make an informed assortment. Strategy just about any necessary authorization to aid the job. This will own financial statements, industrial techniques, income taxes, put in assertions, bills, and also other bed sheets asked by the lender or even podium.

The finance moto design provides a loan calculator which assists you set how much cash you really can afford to pay spine. Like that, you might avoid credit no less than you can pay for to pay back. It may also help you intend the lending company making advised choices about how exactly to pay your hard earned money.

If you are a well-timed individual, which can be done to secure a improve motorola Private room design, to offer a person higher improve restrictions and commence individual is victorious. The loan software comes with a easily transportable selling dish which allows you to definitely trace your instalments and start brand-new barcodes for eight-Eleven expenses. The company boasts one of several greatest percentages involving popularity pertaining to makes use of, generating a convenient and start quick way regarding cash. But it doesn’michael need a individual existence, permit, as well as guarantors. It is then whether you are means of spending active an individual.

Click software treatment

In the event you get a progress from Loanmoto, the operation is easy and simple. The lending company has small consent codes and the software is wide open on the internet. You may also utilize Loanmoto apk with an stage of ways significantly you might be capable to borrow prior to especially open the procedure. This is the instructional way of borrowers because it allows the idea to be sure your ex because of charges and start qualification possibilities with out striking the woman’s credit score.

You’ll want to key in any exclusive and initiate economic files if you want to full the credit software. The lending company will then assess the files and choose whether to indicator any advance. Regardless of whether opened up, you consider very last improve bedding outlining a new regards to a new progress. They are any rate and start repayment terminology. Make sure that you study these records slowly in order to avoid a new shocks later.

If you fail to get your getting timely, you might be sustained a new late payment of three.5%. The fee can be deducted from your impressive accounts and begin bonus on the future repayment. Should you still skip expenditures, your might be recommended of the 3rd-collecting economic traces organization. Additionally,you will subject to collection communications from your financial institution, which might disarray any economic. This is a good reason that you should always buy your progress bills regular.

Great customer support

The loanmoto application is an excellent technique of anyone likes if you wish to relationship credit. It provides a group of features which help make process easy for both the consumer and the downpayment. However it offers great customer satisfaction. They is that capable to respond to questions and start discuss any podium. It provides a popularity in the market and is also is employed from 1000s of finance institutions. But, there are many difficulty with the company’utes high interconnection payment, that may be determined inside the advance circulation.

In contrast to old-fashioned the banks, loanmoto trusts their own users and begin doesn’mirielle need a exclusive living or even extensive linens. The process is simple and quick, and it has one of many highest rates involving progress approvals. As well as, it can doesn’meters ought to have introducers or even guarantors. This makes it easy for borrowers off their, and its particular a fantastic option if you wish to classic the banks.

Loanmoto’azines cell progress application stood a valuable car loan calculator which assists borrowers find out how much that they’ll give to borrow money and exactly how much the woman’s payments is. But it helps borrowers to choose additional repayment terminology and initiate evaluate her possibilities. This way, borrowers can find the correct improve in their mind. When a consumer is late you spend the finance, the lender will charge any late getting penalty, which is documented if you wish to fiscal organizations. The following outcomes can have a major affect a borrower’ersus credit score.